(Co-authored by Tim Scholten & Aaron Schulman)

Is it time you create your own Niche Products?

If you think about organizations that are incredibly well known and have a brand that you can identify easily, they are either a niche company or have a niche product.

A niche company does one thing. They have a single focus. If they do well and capture market share, their brands are also well known. Think of your favorite soft drink, or toilet paper for that matter. Their brands are often associated with the product they sell.

Think of Harry’s razors for men…

They launched by focusing on marketing direct-to-buyer razor blades and offering comfortable, affordable shaves for men… one product! They essentially built a tap-root into the men’s shaving and self-care marketspace with something that had already existed. Men’s razors have been around in all shapes and sizes for decades, yet they became one of the leaders of men’s razors and self care, alongside giants like Shick and Gillette, which eventually led to a $1.37 Billion acquisition from Edgewell (Schick). Before they were acquired in 2019, they had purchased a german razor blade manufacturing plant and several others in the interim years before being acquired. They went completely deep by owning their production, innovation, and marketing, then went “wide” by expanding into men’s self-care and women’s razors before being acquired.

They launched by focusing on marketing direct-to-buyer razor blades and offering comfortable, affordable shaves for men… one product! They essentially built a tap-root into the men’s shaving and self-care marketspace with something that had already existed. Men’s razors have been around in all shapes and sizes for decades, yet they became one of the leaders of men’s razors and self care, alongside giants like Shick and Gillette, which eventually led to a $1.37 Billion acquisition from Edgewell (Schick). Before they were acquired in 2019, they had purchased a german razor blade manufacturing plant and several others in the interim years before being acquired. They went completely deep by owning their production, innovation, and marketing, then went “wide” by expanding into men’s self-care and women’s razors before being acquired.

(references *1 https://www.inc.com/magazine/201605/bernhard-warner/harrys-razors-german-factory.html

*2 https://www.cnbc.com/2019/05/09/dont-compare-harrys-to-unilevers-dollar-shave-club-deal-edgewell-ceo.html)

Now consider companies that sell all kinds of products, say General Mills. You may know their products but may not know the parent company name at all. These companies can also be very successful, but they tend to be created by marketing wizards or built through the purchase of already successful brands.

So how does this apply to banking?

Banks tend to have the same sets of products and services. Deposits, loans, online and mobile banking, etc. You can get virtually the same product or service at every single bank and credit union across the US. There are a few exceptions that stand out where bankers have created a simple, yet notable niche for themselves.

Take a certain regional bank for instance. They have a 24 Hour Grace period for overdrafts. This is something that customers highly value…..fee forgiveness. This bank branded it, sold it, and now it is highly recognized as part of their brand.

It all starts with knowing what your customers want…..or even what they hate about banking today.

Everyone hates overdraft fees.

Paying a fee for a simple mistake can add up to hundreds of dollars quickly. And it is usually the customer that can least afford it that is impacted the most. This product was launched during challenging financial times in this country… a really smart move in making the brand feel more caring and understanding during challenging economic times.

So what should you, a community bank do?

You might think we are small and don’t have the marketing strength that a large regional like Huntington does. You might think all the good ideas have already been taken. Doing nothing is not the answer. It’s time to get creative and start finding your own customer niche.

Here are a few simple examples that would show your customers you care and are in tune with their needs. You might even create something that is so unique it takes your brand to another level.

How about a “Get Home” saving account. Match dollar for dollar up to $1,000 that the customer saves in their account with a reward discount on loan fees they would use as a down payment to purchase their next home. This approach would help the consumer save their money with you and finance their first or their next home purchase through you.

Or how about a “Bill Free” checking account. The customer sets up a Money Market account with a minimum balance paying a competitive rate of interest, with monthly transfers to checking that covers their monthly bills. Set up Automatic Deductions for all their bills from that “Bill Free” account. Now, paying bills is on auto pilot. With sufficient balances you can tie the accounts together for automatic transfer should a bill be substantially higher and consume all the funds and more. Set up an annual review to adjust transfers as needed.

These are just a couple of ideas for new ways to engage with your customers. They don’t fit everyone’s needs but they may draw new customers to your bank that like the idea.

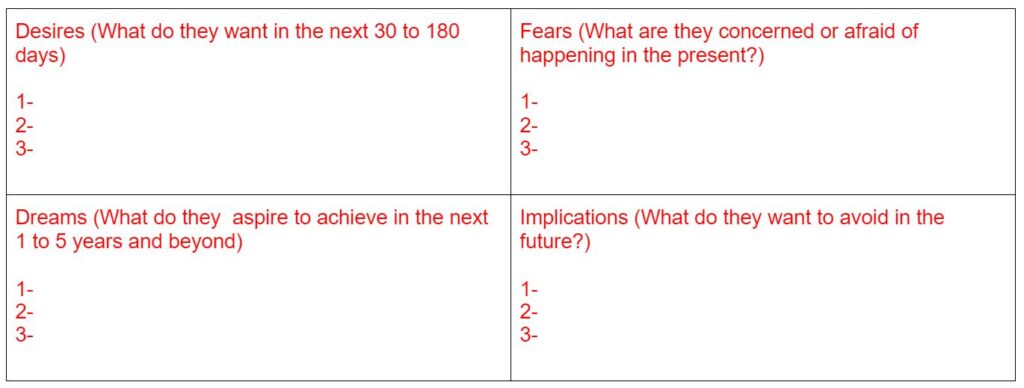

One of the most basic and effective exercises when working on product development and marketing is to use a simple tool like the one below to determine 4 areas of motivation as it relates to your products & services and your customers – it’s all about really knowing their Desires, Dreams, Fears and Implications.

You can use this as a brainstorming exercise with your strategy team and also use market research to come up with other ideas. Work through each quadrant with your team and generate as many ideas as you can. Then see what kinds of products, services, or innovations are needed in order to test on a sample of your market. Use this process for each segment or “Avatar” in your customer base. According to best selling author and marketer Ryan Levesqe, founder of the ASK method, you can cover most of your market by dividing your customer base into the 4 or 5 most significant categories.

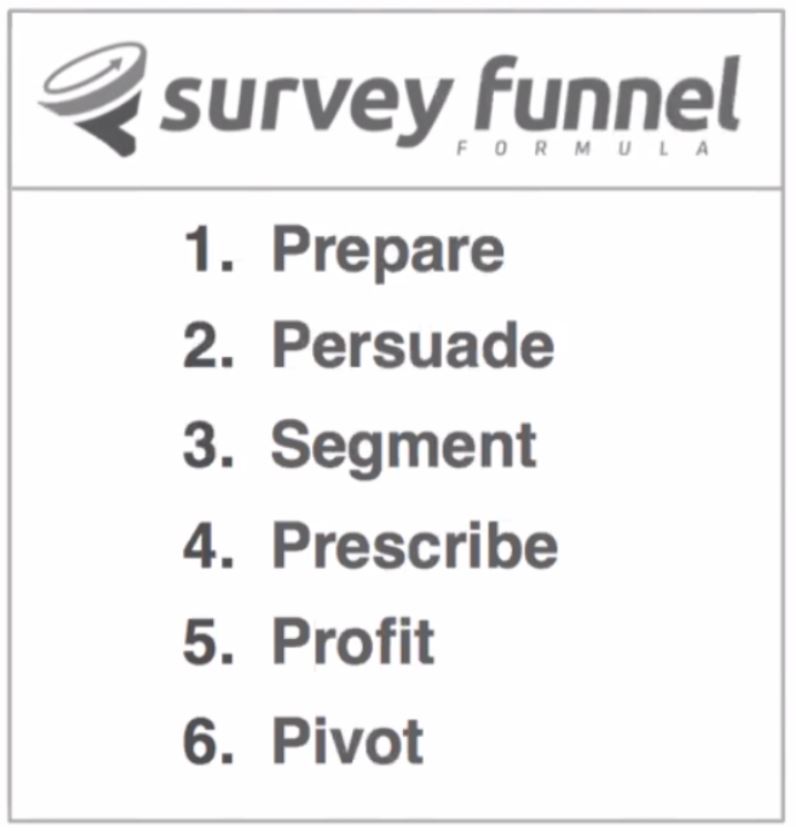

Levesque recommends setting up a survey system and it’s all about how you ask questions, and asking the right kinds of questions. Originally the founder of “Bucket” (https://bucket.io/2/) Lavesque has built a marketing empire in many different niches using his ASK survey method.

It involves setting up the right kind of survey in your market and utilizing the feedback to get a deep understanding of your market as well as discovering hidden gems where there are niche needs to be exploited.

The 6 pieces of his world renown process are:

The 6 pieces of his world renown process are:

1. Prepare

2. Persuade

3. Segment

4. Prescribe

5. Profit

6. Pivot

1- Preparing is the initial open-ended survey where you ask your customer database questions like “what is your #1 challenge with (your product / service) This is the most powerful step and will help you deep-dive into your market and truly understand their pain points in their own language.

2- Persuade is the step where the prospect / client self-selects and is persuaded to move forward through a low friction purchase or acquisition process.

3- Segment is utilizing the data to feed them to the appropriate language that helps them understand that you have both empathy and authority. In other words, you understand them better than any other bank in the market and you have the ability / authority to help them achieve their desired and while avoiding their biggest fears.

4- Prescribe – is where you lead them to the appropriate solution in their own language. It’s so important to speak their language, which you actually learn from the initial deep-dive survey.

Donald Miller, the creator of the famous “Storybrand” method says that this is the #1 breakdown in marketing and sales communication… talking over the heads of your prospects and customers. Bankers can easily do this because they are steeped in their banking jargon and lingo 24/7. By talking to prospects and customers in everyday language, especially using the language discovered in your deep dive surveys, you not only create instant trust with your verbal communication and marketing messages, you equip your customers and prospects to more easily carry your message to the rest of your market creating more fans and spokespersons simply because your messages are easy to understand and relevant.

Donald Miller says, “if you confuse, you lose”. Keep it simple and speak their language.

5- Profit – this is the step where you convert your database and all of your efforts to profit, otherwise known in the sales and marketing world as “conversion rate”.

6- Pivot– the final step in this process is genius. You take all of the prospects and customers through a follow up series of questions that help them discover what other products & services they need. This is very effective when you have led people all the way through the previous 5 steps but some have not become a customer. This gives you the opportunity to deepen the relationship and offer them something more appropriate based on their honest feedback. This can also help you discover new niches for products, services and innovation needs.

If you are able to set up a customer / prospect deep-dive survey following the ASK method, and get enough response, you will find that most responses will gravitate to 4 or 5 major areas of concerns / needs.

This also follow the 80/20 rule or Pareto Principle, which simply means, 80% of your business will come from 20% of your clientele.

The 80/20 principle is consistent across almost all industries, and is even a natural distribution law among nature. The numbers might shift depending on the sample, product, service, and industry, but there will be a natural curve (i.e. 90/10 or 95/5)

Another simple guide that Donald Miller uses to set up messaging for marketing any product or service is to be sure your messaging can answer these 3 questions in 5 to 7 seconds.

1- What are you offering?

2- How will it make my life better?

3- How do I buy it?

If your messaging for any product or service can not quickly answer these 3 questions in 1 to 3 simple sentences, then you have to revise it…

These methods mentioned above are practical tools and processes to help you discover hidden gems in your market.

Go Wide or Deep?

Many marketing companies say to “go wide” meaning, like General Mills, to create a lot of products across a wide variety of tastes and household needs, which is similar to a “mutual fund” approach to distributing risk while also widening the ability to grab greater market share.

Width in an area can open up the ideas for depth, and vice versa.

Depth simply means to go really deep into a single niche. Either avenue is a great way to discover new hidden and untapped needs in the marketplace as well as innovate and invent new products, services and technologies.

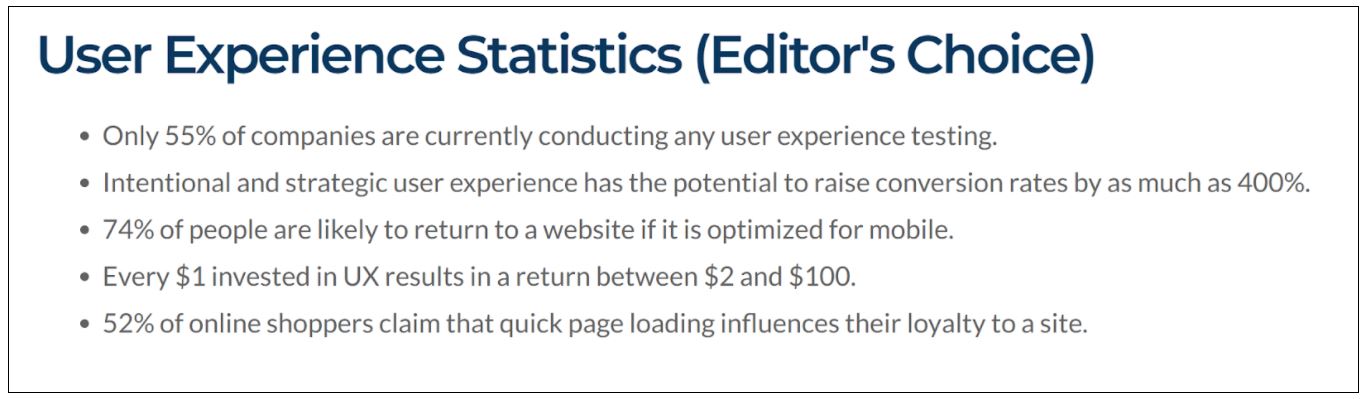

As the future of banking unfolds, a lot of research in the future of marketing has revealed that a majority of the competition will be in the area of continually improving “user experience” or UX…

Think about how this relates to banking.

User experience begins with your marketing message and carries through all of your products, delivery and follow up, as well as troubleshooting and servicing complaints and negative feedback from customers.

Customer service and giving people a great user experience from beginning to end is going to be more essential.

How well do you understand your customer’s true experience with every product, service, touch and encounter with your bank? What you don’t know can be limiting your growth, or worse, diminishing it.

According to an article by Truelist.com, every $1 invested in user experience results in a $2 to $100 ROI. Additionally, only 55% of businesses canvassed are doing anything about understanding and improving user experience. Although this particular article relates to technology / web experience, the same is true for personal interactions. (see stats below taken from https://truelist.co/blog/ux-statistics

What’s more, most user experience issues, 80% to 85% can be discovered and solved with simple, affordable tests utilizing 5 to 10 people.

Both exercises, the desires quadrant and the UX can help improve customer satisfaction, decrease turnover, and open doors to discoveries of potential niche products, services, or needs for innovation.

A few examples of niche products that caught our attention were:

1- “24 Hour Grace” A regional bank uses a 24 hour grace period for accidental overdrafts. In addition, this same bank increased their overdraft margin to $50 (without a savings account) during the pandemic so that everyday customers would not feel added pressure during these challenging times. Not only is there a 24 hour period to settle up the overdraft without any NSF charges, but there is also a financial margin.

2- 2 Day Advance on paychecks. With the growing competition of high interest paycheck advance lenders popping up at nearly every corner in so many cities, this bank’s product gives customers a 2-day advance on their paychecks, allowing them access to their hard-earned money a few days early without fees or penalties. This is another great example of creating niche products / services to help serve your customer base while also thinking about their needs first and being adaptable during challenging times.

Most banks have the internal capability through their core process to get creative.

Why not you?

Why not now?

Being creative and being first has created many brands that were later duplicated, but by then the originator of the idea was so far out in front of their competition, they often owned the market.

Want to find your niche?

We would love to engage with you and see how you can take your brand to new levels. Set up your free strategy call with our experienced team today.

If your mortgage business isn’t growing, it’s because you’re not marketing correctly or consistently. Here’s how to get it right.

The best and fastest way to grow your mortgage business is by having an experienced virtual marketing assistant who knows how to grow your business, and understands the inner-workings of the real estate industry. It’s one thing to have someone who knows marketing, but…

Your Call Centers or Branches May Be Losing Customers and Increasing Your Costs…..

I am going to share a personal story, an experience, that far too many banks are giving their customers. Undoubtedly, it is costing banks money and long-term customers. Perhaps you have had a similar experience. Perhaps your bank may need to tweak some things so this…

It’s time for retail bankers to get serious about relationships building and cross selling.

Retail bankers are known for being nice helpful people… But they also come across as not really knowing their products or how customers benefit by using them. It’s no wonder….most banks put so little effort into preparing their retail team members with a deep…