In this article we share the 6 keys for a winning strategic plan for community banks, and the Market-Beating Strategy workbook to help your team get flawless execution and whole-team buy-in.

This article includes:

– Target Customers

– Products

– People

– Delivery

– Service – hyper-personalized CX

– Sales & Marketing

– W3

– Market Beating Strategy PDF for Banks

In order for your bank to have a winning strategy, one that keeps you ahead of the market and your competition, while winning the continued favor of all your client segments, your strategy must not only address the 6 keys to a winning bank strategy, but it must also have a way to create 100% buy-in from your team so that execution is consistent and continually builds momentum.

Clarity is essential. In the absence of clarity, people will define it for themselves. This happens all too often. Leaders assume that since they have developed and communicated a plan, the team is informed and on board. Clarity takes time and repetition. It requires that peoples’ “why” questions must be answered before you obtain their commitment and buy-in.

While many banks invest significant hours and dollars into their strategic plan to “satisfy” shareholders, most strategic plans end up sitting on the shelf, collecting dust.

Why is this?

Because they are not distilled down into a simple, daily, actionable plan that can be summarized on 1 simple sheet.

While there is no specific order by which your strategic plan must be created, there are specific items that must be addressed along with a simple, flawless execution and accountability plan so that the entire team is engaged in turning your plan into reality. This requires the entire team to work cohesively to ensure that sales, systems and operations are running like a well-oiled machine.

#1 TARGET CUSTOMERS

Let’s face it, customers are always the name of the game. How we acquire and keep customers satisfied is just as important in banking as it is in any other type of business. We need simple, effective ways to acquire customers and retain them better than our competition while maintaining competitive profit margins.

Business Owners

Your team has to decide what your focus will be, whether to target business owners as customers, or consumers, or a combination of both. You will have to decide what percentage of each you want to acquire. To keep it simple, acquiring businesses as customers means lower volume but higher lifetime value (LTV) per capita.

Consumers

Acquiring consumers as customers is generally the opposite, i.e. higher volume with lower LTV per capita. There’s nothing wrong with deciding on a mix of both B2B and B2C targets, as long as you have a clear acquisition strategy with clear benchmarks and ROI.

For businesses and consumers alike, you will need to intimately know 2 things:

Their Needs & Preferences.

You will also need to keep track of the cost per acquisition and the costs of maintaining their satisfaction and loyalty.

Some of the best ways to develop an understanding of their needs and preferences is to study your competition, test things with small samples of your total customer base and get customer feedback. They say that no strategy survives the first day on the battlefield, and while this may be true, customer feedback while understanding and foreseeing predictive trends in consumer behavior changes and insight is your number 1 tool for keeping a pulse on their needs and preferences, while begin able to stay ahead of the curve and make changes that serve where the market is headed and where consumers want to be. This is the difference between reactive strategy vs. proactive strategy.

In other words, the better that your bank strategy can predict coming changes in the ways the consumer thinks and desires to be served, and what they truly want from their banking experience, the better your bank will be able to acquire, serve and retain loyal customers.

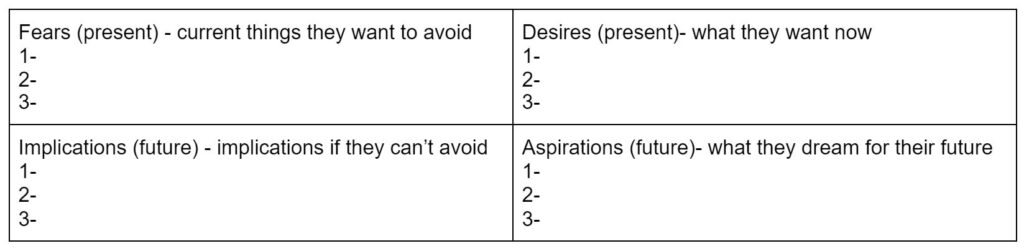

To understand their needs and preferences, deep market research and trends are great guidelines to begin, but these don’t often reveal specific needs and desires. Also, you can implement a simple marketing tool we call the prospect profile quadrant, which helps you identify each segment’s desires, aspirations, fears and implications. This simple but powerful tool can help your team get into the heart and mind of each avatar (profile) in order to understand their present fears and desires, while looking out for them in order to help them avoid the future pitfalls they are afraid of while helping them design the future they desire. Using this simple tool, you can brainstorm with your team to get a firm grasp on each of your customer segments so that the rest of your strategic plan will be on target, solving real problems while fulfilling true customer needs.

#2 PRODUCTS

Next, after understanding your desired market share, their needs and preferences, you must have a systematic approach to develop the best products that meet those needs in terms of design, delivery preferences, and pricing. If you miss one of these by for your target demographics, it can create significant hurdles on your road to achieve your desired market share. It’s always good to keep an eye on your competition, but this is only a starting place. Often, it is more helpful to get outside expertise, especially from professionals who are inside the banking world and outside.

What does this look like? Over the last 20 years, a phenomena has occurred with the marriage of “crowd-sourcing” and “social innovation” to create breakthroughs in almost every sector of society, from medical advancements, to computer development, to online business growth.

By shifting Research and Development (R & D) from a “closed environment” to an “open environment” innovation and advancements in just about every industry have soared to new levels of innovative speed as well as advancements in quality.

The front-runner in this concept began with open-source software platforms that turned into global communities of innovative collaborators who cross industries to achieve advancements much faster than developing from limited lanes of experience.

In other words, if you have ever visited a blog or website, your experience was most likely enhanced by Linux, WordPress, or Drupal.

People from all walks of life work in voluntary communities to rapidly develop, maintain and evolve Internet Code and software through “crowd-sourcing” and instead of leaving the entire development to a narrow set of trained technicians (i.e. only those experienced in writing and developing code) the code bases were opened to a global community or a volunteer army with a vast array of problem-solving backgrounds!

The problem with software that is developed from a “closed” community is that those professionals are trained to see things with a limited perspective, within the confines of the science of coding. This is a generality of course, and we will share how this relates to the limitations on bank innovations in a moment. However, the idea can be extrapolated to virtually any industry, and it has. People with no medical backgrounds have helped do research and bring innovative ideas to medicine and medical technologies wherever “crowd sourcing” was able to have influence. This is why WordPress is one of the most popular and widely used website building softwares available around the globe. This is also why it is one of the most secure softwares. People from all walks of life, amateur and professional, are able to contribute innovative ideas and different perspectives on the development of the code base, and the community continues to grow.

Imagine if this same open concept were employed in the banking sector. Corporate bank teams and leaders are generally a fairly closed group when it comes to R & D, and therefore the banking community tends to lag behind when it comes to true innovation and staying ahead of customer desires and needs.

Bringing in an outside consultant is always a good idea for bank leaders to bring a fresh perspective, and the more diverse the background and experience of these “outsiders” the better chance your strategy will be leading edge instead of lagging behind. Let’s face it. Banking is filled with people who simply do what most other banks do. There is nothing unique or exciting about most of them. They simply call the same old thing something new and hope their customers buy it. The approach described above creates real innovation and ideas for addressing real customer needs, many of which have gone unaddressed for years. This is where real opportunity resides.

Product Design

The next area of strategic focus is product design. The design of your products must identify both the aesthetic appeal (consistent branding, ease of use and quality) as well as meet the unspoken needs and concerns of the customers. In order to do this, you have to put your focus on both the current and future desires of your customer “avatar”. The avatar is simply a profile of your average customer, from their age to the kind of socks they wear, and the type of music they like to listen to. Most of your customers will usually fit into 4 or 5 avatars to make up 80% to 90% of any market. Regardless of how diverse your market base is, you will find that 60 to 80% of your customer base will fall into 4 or 5 customer segments with similar desires, needs, concerns, fears etc.

Product Delivery

The delivery methods of your products must not only meet the needs of your customer base, but they must also be leading edge or innovative in terms of where your consumers are heading. Being behind on delivering modalities and technologies is unacceptable and will make your market appeal seem archaic or out-dated, and your growth will suffer for it. In layman’s terms, finding more unique ways of getting your products into customers hands is where there is real magic. Think about the following examples: A candy store gathers their customers email list and begins taking orders online and delivers right to their door. A small candy store can quickly expand their business and customer base geographically with little to no additional cost.

As a bank it could mean expanding your service outside your foot print by creating the ability to serve your client base anytime and anywhere. Most people think that only large entities can afford this sort of development, when in reality most true innovation occurs in smaller organizations. It is simply finding a niche and then creating your own unique way of solving that specific need.

Product Pricing

Product pricing is a no-brainer. There must be enough margin to be competitive without going into the red. Using automation to reduce the cost of products and services will allow you to offer these services at competitive prices that may help you attract a greater percentage of customers. When you pair competitive pricing with expanded delivery capabilities you create an amazing recipe for growth. This has been a model that Walmart has used for decades. Being great at sourcing and logistics has allowed them to offer the most competitive prices that draw customers in from greater distances because of price. Fewer stores where customers will make a longer drive to stock up is a great recipe for success. This requires a real disciplined commitment to leveraging systems and technology to enhance speed, delivery, and cost advantages.

Sustaining your pricing advantage will require periodic audits and reviews your entire operations as a way to continue the refinement of your operations and as a way to drive costs down while increasing customer growth, satisfaction and retention.

#3 PEOPLE

After understanding your customers and the products they need, your team (your people) are the most valuable asset to your bank’s health and growth. Investing regularly in improving your bank’s culture is vital for morale, which always affects the way the end customer perceives their experience with your bank. The more dynamic and exciting your internal culture is, the more this will spill over into great customer relationships and experiences, leading to higher customer satisfaction and retention. People often ask “How are people part of strategy?” To put it simply, people attract people. People do business with people they know, like and trust. Putting the right people in the right roles is critical when it comes to asking customers to trust you with your finances. Investing in the right people and delivering your services through a well trained team that can guarantee your customers a consistent quality experience will set you apart from most of your peers. Many banks fall short in attracting the right talent and in investing in the ongoing development their most valuable asset..their people.

Structure

Structure is simply how you organize to serve your customers. Keeping your structure as flat as possible keeps leadership connected with the customer. Your structure also needs to support your employees to ensure that they are equipped to service customers better than your competition. In a world where the products you offer are very similar in the customer’s eyes, how well you connect, educate and support your customers will be one of your strongest points of differentiation in the market. Having a supportive structure also will help you attract top notch talent. This means that leaders need to engage regularly with their team members to understand what is working and not working. Structure is about enabling decision making at the closest possible let to where the customer chooses to have contact with the bank. Good structure empowers people to meet the customers’ needs instead of hiding behind policy. Your structure should inform you where your service breaks down and where your customers have needs you aren’t currently meeting. All too often, management creates structures that disconnect them from the customer feedback loop and as a result, the quality of the customer experience erodes over time. Good employees become frustrated because their issues and solutions aren’t heard. And so begins the turnover of employees and customers. Something that a better team structure may have been able to help avoid.

Training & Development

One of the first things to be reduced by many banks is training and development costs during financially challenging times. It is a huge mistake. Honing your team’s skills in every area is one way to develop and retain top talent. People know when you are making ongoing investment in their ability to grow with you. Banks generally state “Our people are our most important asset”. Then they cut the training and development budget at the first sign of margin compression. That shows your people that they aren’t the most important asset. It’s merely a slogan, not the reality.

Now I am not suggesting that during challenging times, you shouldn’t scale back. But I see banks eliminate their entire training budgets during difficult times. You may need to be more creative, but don’t stop investing in your team’s development. They are what attracts and keeps your existing customers coming back. They are the people you need to outthink and outperform your competition.

Good training and development plans will extend the tenure and job satisfaction of your staff. It is one of the most significant investments you can make in your future success.

Create development plans at an individual level to ensure your team is getting what they need, but put the ownership of the plan in the employees hand to ensure they take the initiative to pursue their own development and career goals. It’s something you should lead and encourage but allow each person to drive their own plan at their own pace. This approach allows the best leaders to rise to the top.

Support

People that feel supported by their boss tend to stay with the company. Support consists of the following things:

- Effective onboarding and training to succeed at their job. This is to ensure that they have the right tools, resources and access to leadership that they need to perform their duties.

- A leader alongside them that will mentor, encourage and support them on their journey. Think of this as a cheerleader or advocate that is diligently trying to help them get to the next level.

- Constructive feedback. What do they need to change or do differently to get to the next level? What is it that they may not be seeing about themselves or their own performance?

All too often companies fall short in setting up their newest team members for success by leaving the onboarding or training process to chance. By not taking the time to assess how well their team members feel equipped to succeed in their roles. None of this has to take a lot of time which is the general excuse for not doing it. In reality ensuring the right support systems and structure will guarantee better equipped team members that stay with your organization longer. It will save time and money in the long run.

Part 2 of this article continues on the next post … click here

Don’t Wait – Build The Team You Need for The Future Now

It seems like things are slowing down. Companies are pulling back. I am hearing more about targeted layoffs and downsizing again. Seem like just yesterday companies couldn’t find people, now they are letting them go. From all indications, this will likely be the case…

How to evolve your business regularly to meet the demands of a constantly changing market

(Co-Authored by Tim Scholten & Aaron Schulman) If the last few years has taught business owners anything, it’s how to quickly adjust and evolve to keep up with all the challenges and changes brought on by COVID and rapidly changing mandates and business…

How to get your team to commit 100% to your strategic plan

(Co-Authored by Tim Scholten & Aaron Schulman) The first 5 steps of our Market Beating Strategy TM set your business up for unparalleled success. Once you master these, your ability to guide your team to increasing achievement has virtually no limits. In step 1,…

Get the complete “Market Beating Strategy” workbook developed by seasoned banker, strategist and coach, Tim Scholten, and improve your bank’s strategic plan, team buy-in, and market share.

Get the complete “Market Beating Strategy” workbook developed by seasoned banker, strategist and coach, Tim Scholten, and improve your bank’s strategic plan, team buy-in, and market share.