(Co-authored by Tim Scholten & Aaron Schulman)

Let’s be honest- no one really knows what will happen in the next 10 years with our economy and the entire banking system… however, doing the same thing and expecting different results is the definition of “insanity”. That is why forward and outside the “banker box” thinking is important now more than ever and it includes growing in the ability to see a few key concepts from a 30,000 ft. view…

A- Your People (shareholders, team, customers & prospects)

B- Your Vision (not just what you want to see, but what you need to see for the future)

C- Your Culture & Community (there should be significant synergy where your culture spills over positively into your community)

C- Your Systems / Technology (technology for technology sake is a waste – it must improve everything else

D- Your Operations and Feedback Systems

E- The “Flavor” of Your Impact (what makes your bank different from every other competitor – not about the products – it’s about how your company and culture makes all of your “people” in part A above feel)

F- Your Agility and Adaptability (ability to quickly model and deploy changes that keep customer experience, useful data, digital technology, and the ever changing banking & financial ecosystem influencers in the forefront of strategic change)

Enter, the banker’s culprit: The ever changing financial ecosystem:

Rapid changes have caused new normals for people who want faster service through technology – but we still need the personal touch and hybrid work of technology, automation and human touch… i.e. people still want to be treated like a valuable person and not a commodity… where will your bank be positioned in the next 10 years?

According to a research-based article by Deloitte.com, banking will be completely different in 2030, and banks that are not forward thinking in these areas are going to struggle or go out of business. They recommend studying 8 key trends that will significantly transform the banking industry in the next 10 years.

Their research suggests that any bank that wants to be thriving in 2030 must “embrace emerging technology, remain flexible to adopt evolving business models, and put customers at the center of every strategy.”

The 8 areas of innovation that must remain at the center of banking strategy include:

1- Agility – being able to evolve your business model with bold, shorter cycles. Large ships can’t turn as fast as smaller, more agile ships so size is not the winning factor, but the ability to adjust to constant changes in business models due to more rapidly evolving technology and consumer demands.

2- The Future of Work – concepts like crowdsourcing, artificial intelligence and automation are replacing human working and thinking, therefore allowing opportunities to rethink the kinds of talent they need to hire as well as where to focus the talents within the company.

3- Leveraging technology platforms and monetizing data – Data is no good unless you know how to derive trends and needed strategic changes from the data. All the while, data is becoming more complex in terms of customer experience needs and desires. Banks that can not leverage platforms and convert increasingly complex data into improved customer satisfaction will be bloated down by the information versus being leading edge.

4- Working across the ever-changing bank ecosystem – there are new players in the banking ecosystem such as big tech, fintech, regulators and a rapidly evolving demand for ease and more globalization. In 2030, there will be more influence by these and other influencers in the banking and financial ecosystem, and adapting will be critical in order to navigate and keep your bank afloat.

5- Cybercrime and financial risks – As criminals adapt and become more sophisticated, so must your bank by staying ahead of the sophistication and evolution.

5- Cybercrime and financial risks – As criminals adapt and become more sophisticated, so must your bank by staying ahead of the sophistication and evolution.

6- Data integrity and analytics – As the consumer data becomes more complex and changes at a more rapid speed, banks must adapt to employ 3rd party intelligence to expose transaction data that helps you make smart strategic business model decisions without ruining your reputation or putting the consumer at risk.

7- Innovations from emerging technologies – strong influence from innovations like blockchain, AI and the cloud are not going away and banks must learn to integrate with agility while these emerging technologies impact the processes, workflows and employees in the front, middle and back offices.

8- Embracing the continuous impact of digital technology evolution and innovation – most banks work to incorporate technology but have yet to embrace it as a leading factor in their business modeling to promote bold, agile changes that are in front of the curve and consistently keep customer experience at the front edge. Rather than being reactive to constant changes in digital technology, banks need to shift to make digital technology and customer experience major drivers in their strategic planning and predictive business modeling.

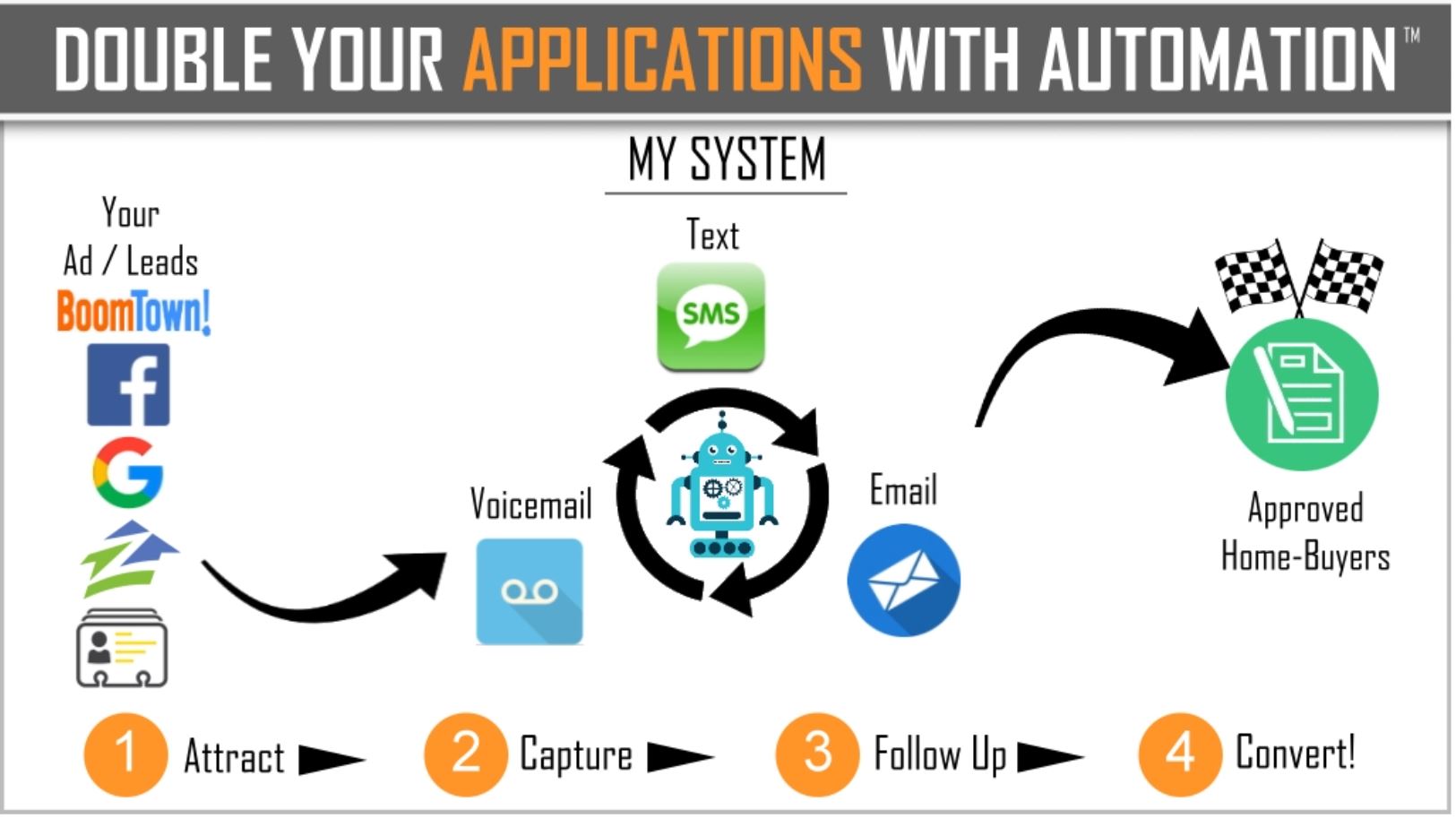

Automation and Artificial Intelligence are here to stay – how we use 3D automation to increase the personal touch, decrease manual outreach, cold-calling etc, and decrease the actual workload while getting higher response rates from both customers and prospects.

Case Study: One of our Mortgage clients had been experiencing stagnated yet substantial success because of challenges and increased pressure to produce the same output with COVID lockdowns. All the while, people still want the same results from their banks and brokers without a lapse in customer service… enter 3-D automation… when properly assessed, implementing 3-D Automation into his workflow allowed him to automate his outreach and marketing efforts without losing the personal touch that are the bane of improperly employed technology and AI. These strategic changes allowed him to reallocate half of a full-time person to other valuable tasks that generate revenue, saving over $25,000 per year in real costs, generating a more consistent outreach that delivered 3X the results.

Imagine this same kind of automation implementation across a branch or region. The savings and reallocation of resources has a positive compounding effect, opening up growth opportunities that were previously out of reach.

Imagine this same kind of automation implementation across a branch or region. The savings and reallocation of resources has a positive compounding effect, opening up growth opportunities that were previously out of reach.

While many brokers and bankers feel the increased pressure, whether real or imagined, integrating smart automation (having the right tools implemented properly) is a significant key for:

High touch -increasing the human connection and making people feel like they are known, and important through smart segmentation – we can’t be one of the banks that goes cold in the human touch capacity – smart automation can take a lot of pressure off this while making more people feel like they are important to your company

High tech – Decrease the stress and workload by employing automation campaigns and segmenting – implementing this into your normal workflow / process and making it a daily habit

High efficiency – Efficiency does not always mean more complex technologies or systems to learn- it can be a small yet powerful system included one piece at a time until your system becomes more lean while becoming more personable…

Reduced turnover – with all of these improvements incrementally injected into your normal processes, you can test each piece and adjust while reducing customer turnover and increasing prospect conversion rates through continual improvement in your customer satisfaction ratings

Increased profit margins – this equates to more energized culture from the top down, including shareholders, and allows for more creative incentive programs for helping employees envision a long-term career with your bank.

Improved company culture – giving your employees the best of the best while helping them understand that you are investing in their success and career satisfaction means lower employee turnover and clearer paths that will help them visualize long-term careers within your bank environment. Nothing increases turnover and unwanted expenses more than a stagnant or negative bank culture that values the profit over the team… It’s one thing to say it but it’s another to carry it out!

Systemization of your business – adding well sequenced processes and communications with 3D Automation helps you optimize the success and consistency of execution of tasks. This means, no more guesswork… no more hoping people make the calls or hoping they communicate in the way you plan and desire. Now it’s your way, your voice, on your time, every time, consistently. Things happen like they are supposed to happen, by reducing human error while improving customer experience.

Consistency with High-Quality fosters an improved reputation. Now you can leverage other simple tools like video testimonials captured automatically to provide social proof of your superior performance and customer experience. With more customers making buying decisions through the internet, this is another low-cost but critical tool that can raise your social value.

Leveraging technology to minimize the mundane tasks also tells your staff that you value them for thinking planning, executing and improving the overall customer experience. It helps them see that they are worth more to you than what you use technology for.

Other major threats to banks and traditional banking business models include fintech companies on a smaller scale, and Big Tech companies on a larger scale. While many Fintech companies offer and develop innovations that can create better solutions and user experience in finite niches in the financial ecosystem, many banks with larger budgets can recreate these in-house and adapt as needed, thereby eradicating much of the threat of the continuing innovations from Fintech companies. Often, those banks that can not afford the innovations are finding themselves developing partnerships with these Fintech innovators in order to survive or thrive.

Other major threats to banks and traditional banking business models include fintech companies on a smaller scale, and Big Tech companies on a larger scale. While many Fintech companies offer and develop innovations that can create better solutions and user experience in finite niches in the financial ecosystem, many banks with larger budgets can recreate these in-house and adapt as needed, thereby eradicating much of the threat of the continuing innovations from Fintech companies. Often, those banks that can not afford the innovations are finding themselves developing partnerships with these Fintech innovators in order to survive or thrive.

Where the real threat for many banks might lie is in the influence of Big Tech companies like Facebook, Google, Apple and Amazon who are able to innovate with financial and lending solutions for a myriad of clients while taking advantage of internal data at a great advantage to many regional and smaller banks. According to an article by SP Global, Big Tech has already used their massive reach, visibility, customer base and brand loyalty, as well as enormous investment capabilities to impact the financial industry where barriers to entry are low, such as transaction revenues. They could pose a much bigger threat, even to large banks by leveraging their brands and influence by entering more aggressively into the banking realm. Any one of these companies could make a bold move into the banking realm that could forever shift how banks must adapt to survive. For now, regulations, loan underwriting and servicing, and other barriers to entry are keeping these behemoths at bay, or so it seems.

As we move boldly into the future of banking and look to be leaders when the clock strikes 2030… we need to be sure we are adapting and leading with what consumers want now, and what they will continue to want in the future…

How will we know what these things are?

Although the solutions are not simple, the principles that are driving constant change are. The clues come from the trends discussed above, as well as this recent study from The Financial Brand.

They made these 3 bold suggestions: that “tech companies are winning the battle for payments, branches will disappear, and mobile banking [will continue to dominate] delivery options.”

While they state that financial institutions still maintain a big edge over Fintech companies, consumers still want more personalized advice and new security tools, showing a future hybrid will be necessary and driven by both consumer demand and continuous technology innovation and adaptation.

The secret to the success of your bank as we think forward to 2030 are highlighted from recent statements made by the digital platform, MX. They summarized 2 ongoing trends that are simple in concept yet challenging to maintain for any bank as the future continues to increase in complexity and speed of change.

These 2 “currents” that will continue to be the dominant influences that drive consumers in their daily choices are “more choices and less friction”.

And, these 2 currents are completely intermingled with each other, inseparable in how they shape the trends in all influencers in the banking ecosystem. Much like the deep currents in ocean waters that are not influenced by changing winds above the surface, these 2 factors will continue to force banks to innovate with their eyes wide open, or become a relic in financial history. How your banks plans to implement a future where more choices and less friction are at the heart of every strategic plan and innovation with the end consumer at the heart of the “machine” will determine where you will be in 10 years.

So, how is your bank responding to the inevitable changes in the digital and social landscape?

Are you resistant or adapting reluctantly or reactively?

Or, are you grasping the reality of the social, digital and consumer driven age in which we are now deeply entrenched?

Here are two practical steps you can take now to ensure that you are not losing sight of critical developments in banking technology:

Assemble an internal innovation team. Charge the team with looking for technology solutions that will enhance your customer’s experience, automate things done manually today, or help streamline your processes. Get help getting the right people on your team and catch the vision for how they can create a bright future for your organization.

Make sure you have or add someone with deep technical skills to your board. This is and will continue to be one of the most critical roles your bank will need going forward. Oversight of your technical developments is increasingly essential to your operation and how your bank will be evaluated by regulators. A board that lacks this skill may stagnate your development or at a minimum be criticised for lack of oversight.

Figure out how to incorporate the concept of crowd-sourcing into your strategic team. Simply put, this means hiring outside people with expertise in areas that are totally foreign to the banking ecosystem, but they have creative strengths and accomplishments in other areas. These people will challenge the status quo and will help bring continually fresh concepts to the often “closed box” of bank strategy and business modeling. Crowd-sourcing began in the software development area where total software development amateurs were invited to work on open-source coding for complex software platforms like WordPress and Drupal, and because they were not trained and ingrained in software language universe, they often found breakthroughs and innovations that were not discoverable by the “tunnel blindness” from being over-trained and uber-knowledgeable in the software field. The same concept has been utilized in some areas of medical innovation around the world too. Why should banking be any different?

How can we help you thrive through the next 10 years of rapid change and challenges?

We invite you to schedule a complementary strategy call to help you take the next steps in being a banking leader when 2030 comes!

If your mortgage business isn’t growing, it’s because you’re not marketing correctly or consistently. Here’s how to get it right.

The best and fastest way to grow your mortgage business is by having an experienced virtual marketing assistant who knows how to grow your business, and understands the inner-workings of the real estate industry. It’s one thing to have someone who knows marketing, but…

Your Call Centers or Branches May Be Losing Customers and Increasing Your Costs…..

I am going to share a personal story, an experience, that far too many banks are giving their customers. Undoubtedly, it is costing banks money and long-term customers. Perhaps you have had a similar experience. Perhaps your bank may need to tweak some things so this…

It’s time for retail bankers to get serious about relationships building and cross selling.

Retail bankers are known for being nice helpful people… But they also come across as not really knowing their products or how customers benefit by using them. It’s no wonder….most banks put so little effort into preparing their retail team members with a deep…