In this article we share the 6 keys for a winning strategic plan for community banks, and the Market-Beating Strategy workbook to help your team get flawless execution and whole-team buy-in.

You can read the first half of this in-depth article here.

This article includes:

– Target Customers

– Products

– People

– Delivery

– Service – hyper-personalized CX

– Sales & Marketing

– W3

– Market Beating Strategy PDF for Banks

#4 DELIVERY

Locations

Access to your bank’s products and services is critical to every community that you serve. In today’s electronic world, more can be done electronically, but being able to connect with a real person is also a factor in choosing a bank, especially when advice is required.

The day of needing a location on every street corner is past. It is no longer affordable to branch in the same manner as years gone by. It is more important to place your branch and support locations strategically in destination areas that people frequent or are easy to get to.

Today, with online banking, call centers and mobile access, customers frequent the branch less, but they will still need to come from time-to-time. So be strategic where you locate these offices and in determining what services you provide from them.

The old hub and spoke model of a larger regional office with all your services accessible there, connected with a network of small facilities and strategically placed ATMs still makes sense. This allows customer access to specialized services for the infrequent times when face-to-face meetings are required. with them traveling to you or you to them.

With more services available through independent sources you can even consider ways of bringing your products and services to their door with things like in home loan closings where services like Docusign won’t work. The more you can bring service to your customer’s door the further you can expand your reach into the surrounding community from that location.

Electronic

Convenience is more critical today than ever. The 2020 pandemic demonstrated just how critical these services are when people weren’t willing to go to the bank. People flocked to these services stressing many bank’s capacity at the start of the pandemic. In many cases banks needed to figure out new ways of doing their business completely electronically. The PPP Loan program forced many banks to figure out how to close loans and open accounts electronically for the first time.

Convenience has alway been a thing driven by branch locations. Now, convenience is shifting again and becoming how user-friendly and accessible your services are not only from the consumer’s home, 24 X 7 but for business customers as well. They both want to do business on their own terms. In order to compete, you will need to continue to invest in ensuring that your electronic capability to both open and service products is robust and available to your customer when, where, and how they want it.

#5 SERVICE

Customer Support

Customers expect timely, quality service. This means service is available when I need it. It means they want to receive high quality service where their questions can be answered and problems solved right away. And it means that their needs are met with little to no FRICTION. Are you easy to do business with or do you make things difficult for the customer? Are your team members committed to meeting the clients’ needs in a fast, friendly manner? This can be done in person or by phone at the customer’s choice. One of the ways this can be accomplished is through the use of journey maps. This shows clearly what the customer will go through in order to have their needs satisfied. Often banks find that the customer journey is designed more for the bankers’ needs than for the customers. That doesn’t make sense. The banker should know how to navigate the complexity of your products, systems and processes, not the customer. It is worth stepping away from your leadership role from time-to-time to experience your own service as a customer. You may be surprised at your own experience.

Another area of customer support that banks are quickly implementing is proactive financial management tools and predictive behavioral mapping within accounts without violating individual privacy. Whereas online banking has simply been a historical account of activity, many banks are using this data in a highly personalized way in order to proactively serve the customer with better insight for personal money management improvements. Banks handle a lot of sensitive data, but leaders are always finding innovative ways to use data to serve the customer at a higher level, creating a much higher value.

As online banking becomes more technical and data-driven, the digital tools being developed for banks are being deployed rapidly and gaining acceptance much faster by the consumer. No longer is it enough to simply have historical bank statements mailed or made available online via PDF, or offering basic transaction capabilities online, but it is becoming the norm for online account management experiences to help provide budgeting and financial management insight within the dashboard of the consumer’s experience.

When online banking was first becoming acceptable to the masses, it was quite a feat to overcome the hurdle of building people’s trust to do any banking online. Now it’s not enough to simply access account information and history or complete basic transactions, but savvy banks are creating tools that, once adopted by the consumers, can help consumers understand their own monetary behaviors in such a way as to provide predictive insights into their monthly budget, spend analysis and offer specific insight to help them make wiser money management decisions based off highly personal data from their own behavioral trends. This hyper personalization is a powerful concept that will continue to shape the forefront of digital banking experiences while continuing to add value to the end user.

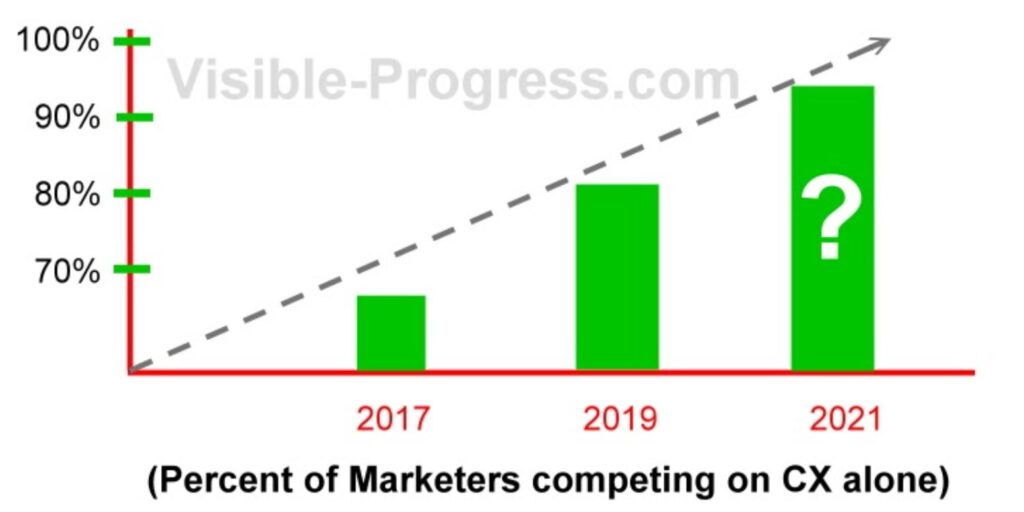

According to a recent customer experience survey by Gartner, customer experience (CX) is the new battlefront. In the last 2 years alone, the trend has risen from 67% to nearly 81% of CX marketers who compete almost completely on the basis of customer experience! This is not just true in banking, but the average consumer is expecting to have a hyper-personalized experience across the board! When they do not experience this, they can easily shop and move their business elsewhere.

Availability

In today’s 24 X 7 world, availability is critical. I am not suggesting that all your services need to be available 24 X 7, but some services do. Like online banking, bill pay, mobile access, for both consumers and businesses. Availability to the day-to-day things like checking a balance, moving or accessing funds, or paying my bills is a 24 X 7 requirement. This simply gets you in the game competitively. It’s the minimum point of entry in banking today. Consumers also want the ability to research products and services at their convenience. In addition offerings like AI created analysis or advice based on customer behavior is rapidly becoming a expected 24 X 7 service. Beyond these there may be other services that you should be offering in your market. These may vary market to market as what makes communities unique is what makes the services they need and availability also unique. For example: Some smaller communities may roll up their streets early on a Saturday afternoon, not to reopen until Monday morning, while others continue with business as usual all weekend long.

How you support your community and what availability is needed can only be determined when you are fully in touch with your markets and understand your customer’s unique needs. It shouldn’t be the same market to market as most markets differ widely.

Quality

Quality encompases almost everything you do in banking. People expect it to be done right by their bank. After all, it’s their money they are trusting you with. So in addition to doing things right the first time, here are some added thoughts on Quality.

Solving customer problems. Whatever their financial challenge is, you are expected to have the answers. Whether it is an in person visit or by phone, clients believe they are talking financial experts. The quality of their experience and availability of answers are a direct reflection of how polite and skilled your bankers are at asking effective questions to understand the clients challenges and solve those challenges with solutions the bank provides.

Customer facing systems must be user friendly. Meaning they are intuitive and easy to navigate. This involves everything from your call menu, web site navigation, online and mobile banking, to business products and services that you offer. The quality of the user’s experience will determine how easy it is for competitors to lure them elsewhere.

How well you know your customers. Every time a client goes into the bank, asking them the same questions demonstrates how little you really know about them. Taking the time to learn information about your customers and store it in your system for future interactions will allow you to build a personal relationship that goes beyond casual and helps to build trust and trust is critical to any financial conversation or advice you offer.

Your solutions are what customers are looking for. Customers generally vote with their feet. They will go where their real needs are met. So how long customers stay with you is one of the ultimate measures of quality. Let’s face it. Your customers’ needs will change with life stages. They generally go from needing to borrow money to having plenty of funds to invest. The kind of advice they need changes from finding a way to afford a car or a home, to finding safe ways of investing for retirement as well as strategies for making money last through retirement.

Wherever your client is in their life journey, they are looking for safe, reliable and trustworthy advisors that can help them navigate the complexities of financial products and services.

In a research article posted by Salesforce, 84% of consumers say that their quality of experience is as important as the products and services they are buying. Quality from the consumers perspective is not just defined as what they buy, but by the entire experience with your company.

(graphic and statistics credited to Salesforce.com)

On top of that, your competitors in the banking space are not the only ones shaping what consumers internally define as a “quality experience”. In many ways, your bank is competing with the customer satisfaction that many people are getting with non competitors as large as Amazon! It is no longer acceptable for bankers to adapt innovation from closed inner circles, but they must continue to push the edge by opening up their spheres of influence beyond the narrow confines of other banking professionals.

#6 SALES & MARKETING

Sales Methodology

I am a huge proponent of needs-based selling. Too many banks have gotten into product pushing. I can give you example after example where product sales quotas cause bankers to sell customers things they don’t want or need in order to keep their job or earn an incentive.

Alternatively, needs based selling requires your bankers to get to know your customers and understand their needs. When they become skilled at solving those needs with the benefits that your products offer, you will create life-time customers and your bankers become trusted advisors to your customers.

That is where the magic happens. Satisfied customers will do the lion’s share of their banking with you because your team has guided them well for a long period of time. That kind of loyalty creates increased profits and a more stable platform to grow and profit from.

What is typically missing with needs-based selling is that bankers automatically go into selling mode instead of asking mode. While the training is fundamental, bankers uncover more needs by asking and getting to know their customers. This allows them to understand and solve deeper problems or opportunities with your products and services. Needs-based selling is an art that requires your bankers to fully understand your products and how they meet the needs of your clients, plus being skilled at asking effective questions.

Sales is just as important of a customer retention strategy as it is a customer acquisition strategy. While chatbots and Artificial Intelligence (AI) continue to become more mainstream for sales, marketing and customer support, the human touch will always be a must. According to Survicate, 63% of consumers are satisfied working with a chatbot for sales and / or service. This leaves a significant 37% of people who prefer to interact with a human being through the entire process. On top of that, 33% of consumers would consider switching to the competition after one negative incident. That’s significant customer attrition! Growing your customer base will continue to be a challenge with that kind of customer attrition. That makes continued customer engagement and cross-selling to address their evolving needs a critical part of any sales strategy.

Marketing Strategies

Marketing (and advertising) in any industry falls into 2 major categories: paid and organic. Simply put, organic marketing is traditionally known as “word of mouth” or any kind of marketing that is not directly tied to paid advertising of some kind. Paid marketing & advertising is where you pay for specific exposure, leads or conversions.

The landscape of digital marketing and social media has completely changed the game in marketing, but it has not altered the fundamental principles of marketing. In short, digital marketing and social media has amplified the speed of marketing and advertising as well as accelerated the potential scalability and potential life-cycle of effective marketing campaigns. One of the most significant challenges today is that many senior leaders have done little to understand how digital marketing works or where and how it can be used strategically as part of marketing and communication strategies. The reality is that younger generations are more engaged with this type of marketing than any other. Not understanding it or not engaging with it will come at a significant cost.

Whatever methods you used before social media, your efforts have a greater and faster potential to become amplified or buried in a sea of noise. Differentiation, accuracy in targeting your message, and consistency are a few keys to being effective in marketing.

Word-of-mouth marketing is still one of the most powerful forces when it comes to your bank’s marketing strategy. Social media and the prevalence of consumers living in a highly digital world has simply made your brand capable of being spread faster while being more accessible, for good or bad. Not only must you provide a better CX than your competition, but you must rival the great experiences that your market is used to experiencing with other major non-competitors. And, your bank has to be able to pivot much faster while handling customer complaints and gathering digital customer testimonials to bolster what many professional online marketers call your “Google Image”. If you are not tracking and responding in a timely manner to what people are saying, your Google Image will suffer, and customers expect much faster response times these days, whether they post a complaint online or drive to your branch to deal with it in person.

The point here is that digital marketing can be a friend or a foe. You need to engage it with skilled professionals just like you do any other marketing spend.

Retention

Retention marketing is the strategy your bank uses to keep current customers not just satisfied, but fiercely loyal. The better overall experience they have with your bank at every touch, personal or digital, the more they will carry your brand into the marketplace and become your “brand ambassadors”. Taking care of your complete customer experience is the first offense and defense your bank can employ in order to keep customers longer, create a higher lifetime value (LTV), and get more organic referral business.

Organic

Your organic strategy begins and ends with how well you offer your current customers an amazing CX. It then crosses over into how well you equip your current customers to bring in other customers and how you incentivize your products. You can amplify this through social media sharing and quality, informative online blog posts that go above and beyond to educate potential customers in your region. Create better, in-depth content for your bank’s public posts and you will see an increase in sharing, perception of your authority and customers. Organic strategies are multi-pronged, long-term and necessary these days when so much information is available at the consumer’s fingertips. Online reputation management is also a proactive necessity. It’s not ok to simply hire a reputation company after your image has been tarnished online, you have to be proactive and treat your online image like you would manage an insurance policy.

In addition, people don’t generally share thin, worthless content and average experiences. Give them great content and experiences and they will share both! In addition, people tend to spread negative experiences or complaints faster than a wild-fire and social media simply amplifies this capability as people have become more bold in sharing negative experiences while social media continues to have the effect of making interactions more de-personalized. In addition, people are loyal to their own checkbook, not your bank.

Paid

The “paid” portion of your marketing and advertising efforts give you more control and potential metrics so that you can realize a better ROI for your efforts. While all efforts for a bank, or any business, cost time or money, your paid advertising and marketing efforts should be tracked and split tested when possible, and when the sample size is large enough, you can employ multivariate or multi-channel testing. This is not a new science, but has proven to be the difference between mediocre, average, and superior marketing campaigns.

Split testing simply means that you test 2 versions of a message, advertisement, post, offering, product presentation, offer, or call-to-action. You can also split test the medium through which you promote a marketing campaign. If you set up proper metrics and feedback mechanisms, you will find that certain messages will outperform others, while different media will outperform others. This can easily change depending on the demographics and psychographics of your intended audience. For example, according to research posted by Vervent, generation X and Millennials favor mobile banking nearly 3 times more than Baby Boomers. In addition, Baby Boomers prefer branch banking approximately 30% more than Gen X and nearly 59% more than Millennials. Knowing your different market segments and hyper-personalizing your marketing campaigns is a must in this digitally diverse age.

Digital

The digital aspect of your marketing efforts should have strategic, measurable (trackable), efforts in the following categories.

-Online banking user experience (UX)

-Digital media / content marketing strategy (think YouTube, Facebook, Instagram, Twitter etc.)

-Search Engine Marketing (Google Image) and Social Media

-Online communication like chatbots, email, and SMS marketing

-Apps and experience across mobile platforms

– Bank website and presence

Having a focused strategy for these channels is imperative, and being able to gather actionable metrics in each area is necessary for your banks ability to beat the competition by optimizing your messaging, campaign targeting, and your CX from prospect nurturing and onboarding, to customer satisfaction and long-term customer retention, working to maximize the LTV of each customer through providing an exceptional, seamless experience.

How effective and actionable is your bank’s strategic plan? Is it an activity that wastes time and sits on your shelf, collecting dust?

Are you able to get 100% team buy-in?

Is your plan so simple and clear that it can be summarized on 1 sheet that everyone can understand and easily implement?

Do you have simple accountability and ownership measures that show measurable progress?

How are you measuring the effectiveness of your strategic plan and the execution of it?

Business is All About Relationships and It Always Has Been

Business is ALL about Relationships and It ALWAYS has been, but do you know how much revenue you are losing because your bankers have never been taught how to use client interactions to build strong relationships? It is obvious to most of us that the statement,…

Get Personal with Banking Clients for Better Multi-Channel Utilization

While branches are still the most expensive delivery channel for your bank, it is still the most effective channel for engaging and educating your customers on how to leverage multiple channels for convenience and timely information. A recent study I read stated that…

3D Relationship Building Strategy

If you are a Banker and you are reading this, you can’t afford to ignore this #1 strategy if you want truly satisfied clients and thriving profitability. They say, “first impressions are everything.” But is your team consistently creating the best first impression……

Get the complete “Market Beating Strategy” workbook developed by seasoned banker, strategist and coach, Tim Scholten, and improve your bank’s strategic plan, team buy-in, and market share.

Get the complete “Market Beating Strategy” workbook developed by seasoned banker, strategist and coach, Tim Scholten, and improve your bank’s strategic plan, team buy-in, and market share.